Effective Strategies For Negotiating Car Accident Claims With Insurance Adjusters

Understanding The Role Of Insurance Adjusters

An insurance adjuster has the primary job of evaluating claims and deciding how much the insurer is going to pay. They often have the goal of providing a smaller payout so that their company’s financial interests are protected. With this in mind, it is important to go into negotiations with as much information and preparation as possible. One of the ways you can be prepared is to understand the motivations and methods of your insurance adjuster.

Preparing For Negotiations

Step 1: Gather Comprehensive Evidence

-

Collecting thorough documentation is an important step in preparing your claim. This evidence will be extremely valuable when it comes time to decide your payout amount. Here’s what you need:

- Police Reports: Police reports or any other official documentation can provide an unbiased account of what happened during the accident. When it comes time to prove fault, the police report will be essential.

- Medical Records: It is wise to keep detailed records of your injuries, treatments, and ongoing medical needs. Some of the medical records you should keep are doctor’s notes, test results, and any prescribed medications or therapies.

- Repair Estimates: When it comes to the damage of property, ensure you get multiple repair quotes. This gives you an understanding of the costs you may be facing and will help prevent your insurance adjuster from providing too low of a claim.

- Photographic Evidence: Visual evidence is a highly credible source. Taking pictures of the accident scene, damages, and injuries gives you evidence that is hard to dispute.

- Witness Statements: If there are witnesses at the scene of the accident, be sure to get statements from each one that is able to corroborate your account of what happened. Witnesses provide valuable third-party viewpoints.

- Medical Expenses: such as Surgeries, rehabilitation, and any long-term care. Be sure you include any current medical costs as well as future ones.

- Property Damage: How much it will cost you to fix or replace any property damaged in the accident.

- Lost Wages: If you were unable to work due to the accident, report how much income you lost as well as any future income you may lose due to injuries that keep you from working.

- Pain & Suffering: You can also report damages that impact your quality of life such as physical pain, emotional distress, and loss of enjoyment of life.

- Evaluation Of Claims: Your attorney will take a look at your claim and evaluate how much they think you can get as a settlement, taking into account all damages, injuries, and legal factors.

- Communication With Adjusters: An attorney will take care of any communications with the insurance adjuster. With their help, you will get the most out of your claim as they can effectively present all the evidence and handle counter-offers with professionalism.

- Evidence Gathering: Attorneys have important resources that help in gathering additional evidence. They can ensure helpful evidence such as expert testimony and detailed medical evaluations.

- Negotiation Skills: Your experienced attorney has the skills necessary to negotiate and counter-offer so that you get the best offer out of your claim possible.

Step 2: Understand Your Insurance Policy

Every insurance policy is different so it is important to understand your specific policy including the coverage, limits, and exclusions. This information can help you be realistic with how much settlement you can expect as well as ensures your insurance adjuster doesn’t low-ball your settlement. Read over the sections on liability, coverage limits, deductibles, and any specific exclusions.

Step 3: Calculate Your Damages

Calculating the full extent of your damages will help ensure you get the payout you deserve. There are many kinds of damages that can be accounted for, such as:

Effective Negotiation Techniques

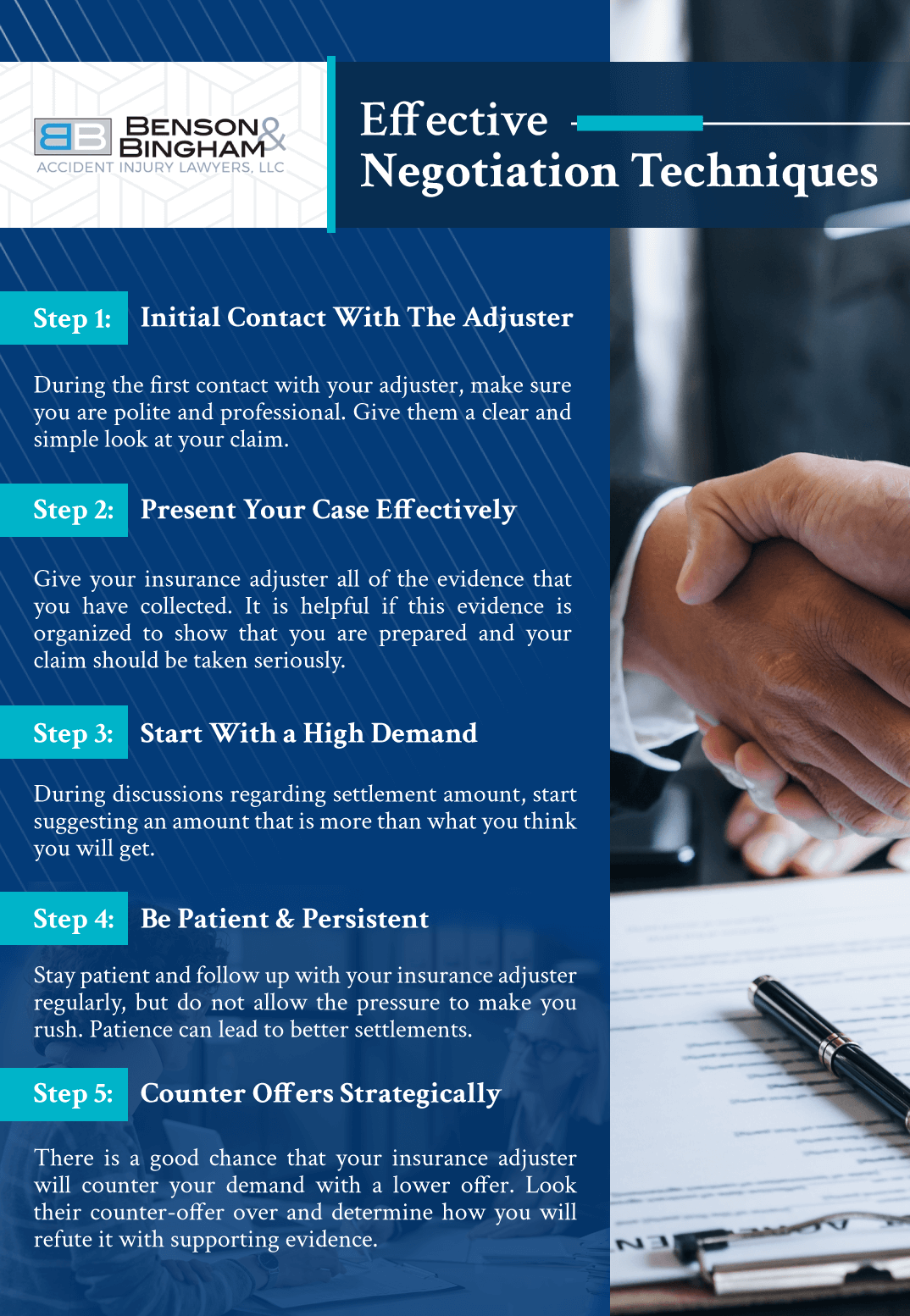

Step 1: Initial Contact with the Adjuster

During the first contact with your adjuster, make sure you are polite and professional. Give them a clear and simple look at your claim, but do not talk specifics or settlement amounts during this time. At this point, your goal is to establish a positive tone for all the upcoming conversations and negotiations.

Step 2: Present Your Case Effectively

Give your insurance adjuster all of the evidence that you have collected. It is helpful if this evidence is organized to show that you are prepared and your claim should be taken seriously. Submit your evidence with a cover letter that gives a clear summary of what you’re providing and how much you have calculated your damages to be. If you document your case well enough, it will be difficult for the insurance adjuster to low-ball your settlement as the evidence will be clear.

Step 3: Start with a High Demand

During discussions regarding settlement amount, start suggesting an amount that is more than what you think you will get. Likely, the amount will be negotiated down, so if you start high, it allows room for negotiation so the final amount is acceptable. However, it is important that your initial amount has evidence to support it and isn’t just a random number, so calculate as much loss as possible with as much documenting evidence as possible.

Step 4: Be Patient & Persistent

This is one of the harder steps, but it is helpful to be aware that insurance adjusters may delay decisions so you feel the pressure to take a lower settlement. Stay patient and follow up with your insurance adjuster regularly, but do not allow the pressure to make you rush. Patience can lead to better settlements. Additionally, it is recommended to document every interaction you have with the adjuster, whether email, voicemail, or snail mail.

Step 5: Counter Offers Strategically

There is a good chance that your insurance adjuster will counter your demand with a lower offer. However, you do not have to give into their counter-offer right away. Look their counter-offer over and determine how you will refute it with supporting evidence. You can mention any discrepancies or low-balls that you notice and send in another counter-offer. The countering process is not a waste of time as each time you do this, you reinforce the strength of your case.

Common Tactics Used by Adjusters

Minimizing Damages

One of the common tactics used by insurance adjusters is to downplay how severe your injuries and damages actually are. Medical records and expert opinions are useful in countering these claims as they are more solid evidence. Use these medical records and expert opinions to refute minimization of your injuries and damages and you will likely be effective.

Questioning Liability

Another common tactic is for insurance adjusters to find a way to place some of the blame of the accident on you. This is another reason to have detailed evidence at your disposal because clear evidence, such as witness statements and accident reports, can help determine who is liable. With this evidence, make yourself ready to defend against false blame.

Quick Settlements

Lastly, adjusters may provide you with a very quick offer that tends to be low. They are hoping you take the settlement right away. Don’t give in, especially if all of the information, such as your injuries or damages, is not known yet. Settling too quickly can lead to an insufficient payout that will saddle you with more expenses currently and in the future to take care of.

Finalizing the Settlement

Step 1: Secure a Written Agreement

Once you have an agreed upon settlement, have the insurance company put all of the terms and conditions in writing. Be sure the settlement amount, what it covers, and any other conditions are detailed on the document. Having the terms written out, ensures your rights are protected and mitigates any misunderstandings. If anything goes wrong, you will always have a terms and conditions document to look back on and use to argue your case.

Step 2: Review By a Legal Professional

Once you have your terms and conditions document, do not sign until you have a Las Vegas personal injury lawyer review the settlement agreement. You want to make sure every detail on the document is what you talked about and that you have a full understanding of the terms. A lawyer will make sure your rights are protected throughout the entire process. If there are any issues with the settlement or terms and conditions, your lawyer will be able to identify the issues and help you negotiate further if necessary.

Step 3: Closing the Claim

Once you sign your agreement with the insurance company, your payment will be processed. You should expect to receive the payment quickly with all your terms being met. The insurance claim closes when you receive your payment and you sign a release form saying that you will not pursue any other legal action that is related to the claim.

How Attorneys Assist In Negotiations

Our Las Vegas Personal Injury Attorneys Are Ready To Help You Negotiate a Higher Settlement Amount

Our attorneys at Benson & Bingham have a thorough understanding of the Las Vegas legalities and will provide you with top-quality results in your best interest. Our Las Vegas Injury Lawyers will gather evidence, consult experts, and strategically negotiate with insurers to maximize your settlement.

Contact us today to handle your insurance claim case while you focus on recovery and moving forward from your accident. Our expertise will ensure that you are not pressured into accepting a settlement that is less than you are owed. Let us help you navigate the negotiation process with confidence and achieve the best possible outcome for your claim.

Read About Our Other Secret Top Tips to Maximize Your Compensation

1. Settle Faster, Settle Bigger: 20 Tips From Top Injury Lawyers for Maximizing Your Settlement

2. Understanding the Insurance Process: Navigating insurance claims and negotiations effectively.

3. Gathering Crucial Evidence: Tips for collecting and preserving evidence to strengthen your case.

4. Documenting Your Injuries: Importance of thorough medical documentation for maximizing compensation.

5. Negotiating with Insurance Adjusters: Techniques for achieving a favorable settlement offer.

6. Understanding Settlement Offers: Evaluating offers and knowing when to accept or negotiate further.

7. Considering Future Damages: Anticipating long-term medical expenses and future losses.

8. Avoiding Common Mistakes: Pitfalls to avoid that could jeopardize your settlement.

9. Calculating Your Damages: Including medical bills, lost wages, and non-economic damages.

10. Proving Liability: Strategies for establishing fault and holding the responsible party accountable.

11. Dealing with Medical Providers: Managing medical bills and liens during the settlement process.

12. Utilizing Expert Testimony: Leveraging expert witnesses to support your claim.

13.Navigating Legal Deadlines: Understanding statutes of limitations and other time constraints.

14. Preparing for Litigation: Steps to take if settlement negotiations break down and litigation becomes necessary.

15. Seeking Emotional Support: Importance of seeking emotional support during the settlement process.

16. Reviewing Legal Fees and Costs: Understanding the financial aspects of hiring a lawyer and pursuing a claim.

17. Handling Subrogation Claims: Dealing with reimbursement claims from insurance providers.

18. Staying Informed and Empowered: Keeping up-to-date with the progress of your case and asking questions.

19. Protecting Your Rights: Knowing your legal rights and advocating for fair treatment throughout the process.

20. Maintaining Confidentiality in Settlement Negotiations and Mediations